The world of event planning, uncertainty often lurks around every corner. From sudden venue closures to unexpected weather disasters, countless factors can derail even the most meticulously organized gatherings. This is where event cancellation insurance comes into play—a safeguard that every savvy planner should consider. Imagine investing hours of hard work and dedication into an event only to see it fall apart due to unforeseen circumstances. That’s a nightmare no one wants to face! Understanding how this type of insurance works—and why it’s crucial—can be a game changer for your peace of mind and your bottom line. Let’s delve into the essentials of event cancellation insurance and explore why it’s more important than ever in today’s unpredictable landscape.

Importance of Event Cancellation Insurance for Event Planners

Event cancellation insurance is a lifesaver for planners navigating the unpredictable nature of organizing events. With unexpected circumstances like natural disasters, illness, or venue issues looming, having this coverage can mean the difference between financial ruin and success.

Imagine planning months for a wedding only to face unforeseen challenges that force you to cancel. The costs associated with deposits, vendor services, and marketing can add up quickly. This insurance helps mitigate those expenses.

Moreover, clients often seek reassurance in uncertain times. By offering event cancellation insurance as part of your package, you not only protect yourself but also instill confidence in your clients. They’ll appreciate knowing their investment is secure against potential mishaps.

In an industry where unpredictability is the norm, safeguarding your business through event cancellation insurance isn’t just smart—it’s essential for long-term success and peace of mind.

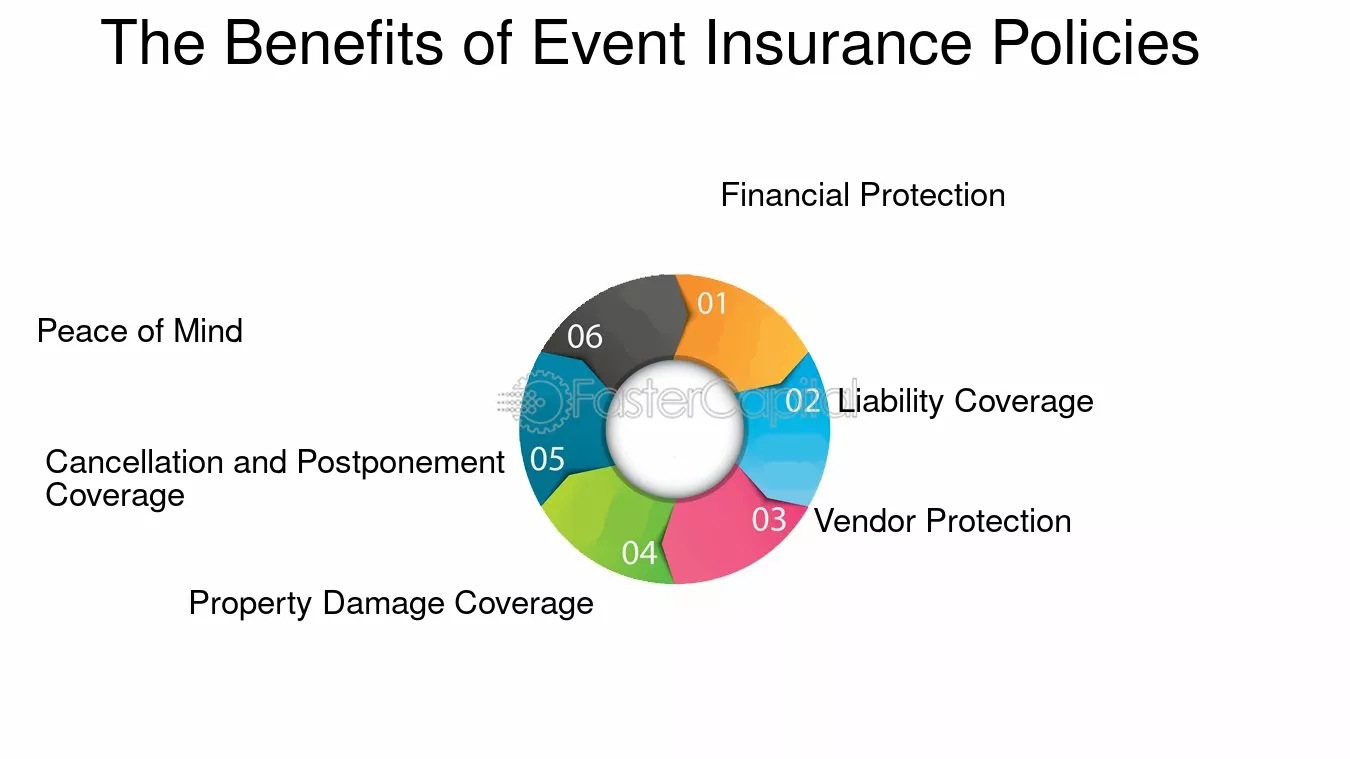

Coverage and Benefits of Event Cancellation Insurance

Event Cancellation Insurance offers a safety net for planners navigating the unpredictable nature of event management. This policy typically covers financial losses due to unforeseen cancellations, postponements, or significant changes.

Imagine investing countless hours and resources into an event only to face unexpected hurdles. With this insurance, you can recoup costs associated with venue rentals, catering arrangements, and vendor deposits.

Additionally, many policies extend coverage beyond cancellations. They often protect against liabilities arising from specific situations like natural disasters or sudden illness affecting key participants.

The peace of mind that comes from knowing you’re covered allows planners to focus on creativity rather than worry about what could go wrong. It’s not just insurance; it’s a vital tool for fostering confidence in your planning endeavors.

Factors to Consider When Choosing an Event Cancellation Insurance Policy

When selecting an event cancellation insurance policy, it’s vital to assess the specific needs of your event. Consider the type and scale of the occasion. A large festival may require more extensive coverage compared to a small corporate meeting.

Next, review what risks are covered. Natural disasters, illness outbreaks, or venue issues can all disrupt plans. Ensure that your policy addresses these scenarios explicitly.

Look into the waiting period for claims as well. Some insurers have lengthy processes which can delay critical reimbursements when you need them most.

Cost is another crucial factor but don’t let it be your only guide. Weigh premium prices against potential payouts and ensure you’re getting value for your investment.

Check customer reviews about different providers’ reliability in times of crisis; their track record matters significantly when you face uncertainty.

Real-Life Examples of How Event Cancellation Insurance Saved Events

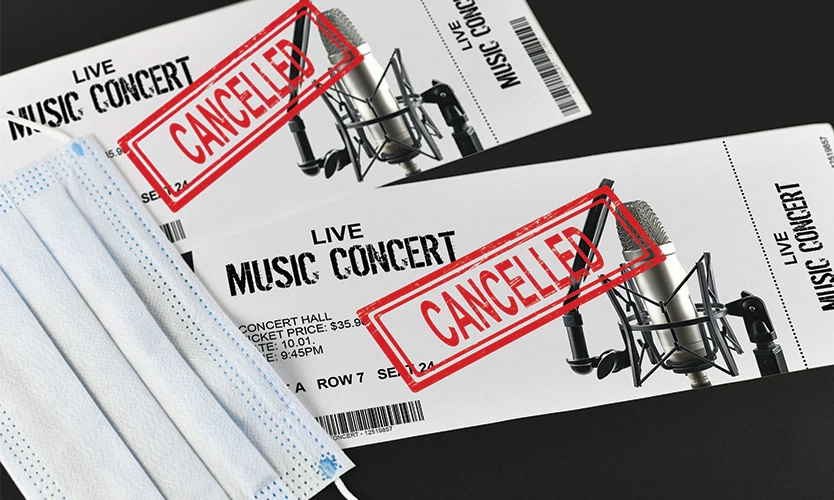

A wedding planned on a picturesque beachfront suddenly faced an unexpected hurricane. The couple had invested thousands into their dream day. Fortunately, they had event cancellation insurance. It covered rescheduling costs and vendor payments, ensuring their special moment could still happen.

Another case involved a large corporate conference set to attract hundreds of attendees. Just days before the event, a major speaker fell ill and couldn’t attend. Thanks to comprehensive coverage, the organizers were able to recover non-refundable expenses and even secured funds for a virtual format as a backup.

In yet another instance, an outdoor festival was disrupted by unforeseen weather conditions leading up to opening day. The insured promoters received compensation that allowed them to manage refunds and logistics without incurring devastating losses.

These stories highlight how having appropriate coverage can rescue events from significant financial setbacks in unpredictable circumstances.

How to Obtain Event Cancellation Insurance

Obtaining event cancellation insurance is a straightforward process, but it requires some planning. Start by assessing your specific needs based on the type and scale of your event.

Research various insurance providers that specialize in event coverage. Look for companies with good reputations and positive reviews from other planners.

Once you’ve narrowed down your options, reach out to get quotes. Be ready to provide details about your event, including dates, location, estimated attendance, and any vendors involved.

Review the policy terms carefully before making a decision. Pay attention to exclusions or limitations that may affect coverage.

After selecting a provider and policy that suits you best, complete the application process online or through an agent. Make sure all information is accurate to avoid issues later on.

Keep copies of all documents related to the policy for future reference during your planning phase.

Conclusion: The Importance of Being Prepared in Uncertain Times

Event cancellation insurance has become an essential tool for event planners navigating today’s uncertain landscape. The unpredictability of global events, weather disruptions, and even last-minute emergencies can turn a well-planned occasion into chaos. With the right coverage in place, planners can mitigate financial losses and ensure peace of mind.

Being prepared means having a safety net that allows creativity to thrive without constant worry about unforeseen circumstances. It’s crucial to not only understand how this insurance works but also to recognize its value as part of an overall risk management strategy.

As you look ahead at your upcoming events, consider the potential risks involved and take steps to protect your investment. Exploring various policies will empower you to make informed decisions that safeguard both your reputation and your finances.

In these unpredictable times, being proactive rather than reactive is key. Event cancellation insurance provides you with the security needed to focus on what truly matters: creating memorable experiences for attendees while confidently managing any unexpected challenges that may arise along the way.

Other Links:

Pandemic-Proof Your Business: Understanding Business Interruption Insurance

On-Demand Car Insurance: The Future of Flexible Coverage for Modern Drivers

Gig Workers’ Guide to Insurance: How Freelancers Can Protect Their Health and Income

Is Pet Insurance Worth It in 2024? A Comprehensive Guide for Pet Owners