Drones have soared in popularity, becoming essential tools for photographers, videographers, and even businesses. With their incredible capabilities, they also come with responsibilities that owners must not overlook. One of the crucial aspects of drone ownership is insurance. Just like any significant investment, protecting your drone makes sense—not only to safeguard against potential accidents but also to adhere to legal requirements.

Imagine capturing breathtaking aerial shots or inspecting hard-to-reach areas without a worry in the world. That peace of mind often comes from having the right insurance coverage in place. Whether you’re a hobbyist flying on weekends or a professional using drones for commercial purposes, understanding drone insurance can save you from unexpected expenses and legal troubles down the road.

Let’s explore what you need to know about this vital aspect of drone ownership so you can fly confidently and responsibly!

Understanding Drone Insurance and its Importance

Drone insurance is designed to protect you from a variety of risks associated with flying your UAV. As the number of drones in the sky increases, so do the potential hazards. Accidents can happen, and having coverage means you’re not left footing hefty repair bills or facing lawsuits.

Understanding your policy options is essential. Drone insurance generally covers liability for property damage or personal injury caused by your drone’s operation. This is particularly important if you’re using your drone commercially.

Moreover, many jurisdictions require proof of insurance before you can legally fly in certain areas. Failing to comply could lead to fines or restrictions on where you can operate.

Investing in drone insurance isn’t just about protection; it’s about peace of mind while pursuing your aerial ambitions. Knowing that you’re covered allows you to focus on capturing incredible footage rather than worrying about what might go wrong up there.

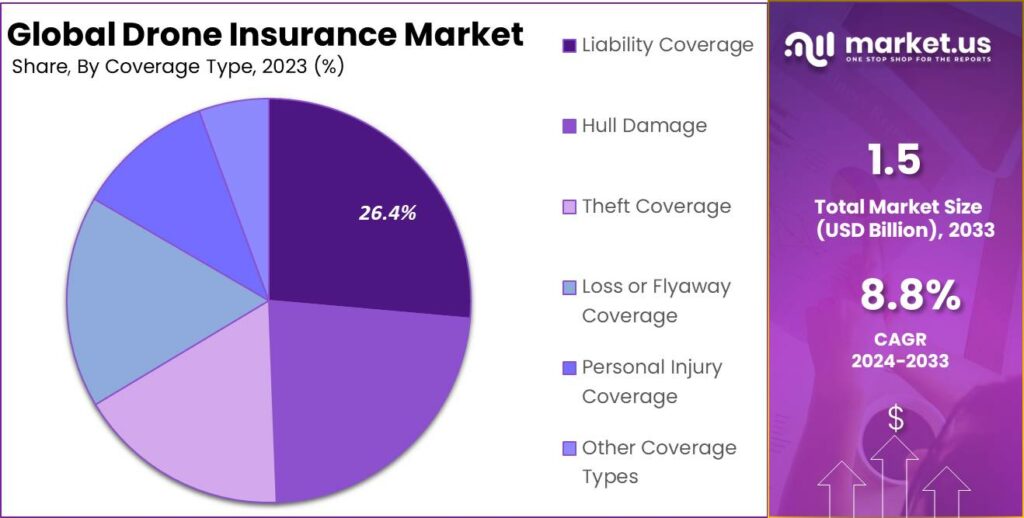

Types of Drone Insurance Coverage

When it comes to drone insurance, understanding the types of coverage available is key. There are several options tailored to different needs.

Liability coverage protects you from claims arising due to damage or injury caused by your drone. This is essential for anyone operating commercially or in populated areas.

Hull insurance covers physical damage to your drone itself. Whether it’s a crash, theft, or vandalism, this policy ensures you can repair or replace your equipment without significant financial loss.

Payload insurance might be necessary if you’re transporting valuable cargo with your drone. It safeguards against potential losses linked directly to the items being carried.

Consider additional coverages like personal accident protection for operators and crew members. These policies provide peace of mind while flying in various environments. Assessing these options will help tailor an insurance plan that meets all your operational requirements.

Factors to Consider When Choosing a Drone Insurance Policy

When selecting a drone insurance policy, consider the type of flying you’ll do. Recreational use might not require as much coverage compared to commercial operations.

Evaluate your drone’s value. A more expensive model needs comprehensive protection against theft and damage. Understand what each policy covers to avoid surprises later.

Look into liability limits. If you’re operating in crowded areas, higher liability coverage can protect you from potential claims arising from accidents.

Examine the deductibles associated with different policies. A lower deductible often means higher premiums, so find a balance that suits your budget.

Review customer feedback on insurers before committing. Reliable customer service can make all the difference when filing a claim or seeking assistance with your policy details.

How to Determine the Right Amount of Coverage for Your Needs

Determining the right amount of drone insurance coverage starts with understanding how you use your drone. Are you flying for fun, or is it part of a business?

If you’re using your drone for commercial purposes, higher coverage limits are essential. Commercial operations often involve larger risks and liabilities compared to recreational flying.

Next, consider the value of your equipment. If you’ve invested in high-end drones with advanced technology, opt for sufficient coverage that reflects their worth. This protects against theft or damage.

Don’t forget about liability coverage too. Think about where you’ll be flying and the potential risks involved—especially if you operate near crowded areas or private property.

Reviewing past incidents can guide your decision-making process. Analyze any losses incurred from previous flights to better assess what level of protection would suit you best moving forward.

Tips for Staying Legal with Your Drone

Staying compliant with drone regulations is essential for every pilot. First, always register your drone with the FAA if it weighs more than 0.55 pounds. This simple step ensures you’re operating within legal parameters.

Know the airspace restrictions in your area. Use apps or resources to check where you can and cannot fly. Flying in restricted zones can lead to hefty fines.

Adhere to altitude limits, typically capped at 400 feet above ground level unless flying near a structure. This keeps you clear of manned aircraft paths.

Keep visual line of sight while piloting your drone; this helps maintain awareness of obstacles and other air traffic.

Stay updated on local laws and ordinances regarding drone usage—rules can vary significantly from one municipality to another, so being informed is key.

The Benefits of Having Drone Insurance

Having drone insurance offers peace of mind. You can fly your drone without constantly worrying about potential mishaps.

Accidents happen, even to the most experienced pilots. Insurance protects against financial losses from damage or theft. This means you won’t face hefty repair bills alone.

Moreover, many clients expect proof of coverage before hiring a pilot for aerial photography or other services. Drone insurance enhances your professional credibility and opens up more opportunities.

Insurance also covers liability claims if your drone causes injury to someone or damages property. This safety net is crucial in today’s litigious environment.

As regulations evolve, being insured helps ensure compliance with local laws and requirements. It shows that you’re responsible and serious about operating within legal boundaries.

Conclusion

When it comes to protecting your investment in drones, insurance plays a vital role. Understanding the different types of coverage available can help you choose the right policy tailored to your needs. Remember that factors like your flying experience and the type of drone you own will influence your decision.

Having adequate coverage ensures that you’re safeguarded against potential accidents or damages while keeping you on the right side of legal regulations. Staying informed about local laws is just as crucial; compliance not only protects you but also enhances safety for everyone involved.

The peace of mind that comes with having drone insurance is invaluable. You can focus on capturing breathtaking aerial shots instead of worrying about what might happen if something goes wrong. Investing in the right insurance policy allows you to enjoy this amazing technology without unnecessary stress.

Taking these steps will ensure that your adventures with drones remain enjoyable and trouble-free, allowing creativity and exploration to take center stage as you navigate through this exciting hobby or profession.

Other Links:

Why Cyber Insurance is a Must-Have in 2024: Protecting Your Business from Data Breaches