Drones have taken the world by storm, transforming industries from photography to agriculture. As these flying marvels become more popular, so does the need for security and protection against potential mishaps. But are you aware of the legal requirements surrounding drone insurance? While many drone enthusiasts focus on mastering their skills in the sky, understanding insurance is just as crucial.

Imagine investing in a high-tech drone only to face unexpected liabilities or damages that could easily be covered with proper insurance. It’s not just about protecting your investment; it’s also about complying with regulations set forth by authorities. Dive into this essential guide to ensure you’re fully informed and prepared when navigating the skies with your drone!

Legal Requirements for Drone Insurance in the United States

Drone insurance is not just a good idea; it’s often a legal necessity in the United States. The Federal Aviation Administration (FAA) has established specific regulations that drone operators must follow. These guidelines help ensure safety and accountability.

For commercial drone use, having liability insurance is typically required. This coverage protects against potential damages to third parties or property during operations. Many states also have additional laws mandating insurance for drones used in certain industries.

Failing to comply with these requirements can lead to fines and other penalties. It’s crucial for operators to stay informed about both federal and state regulations as they continue to evolve.

Understanding your legal obligations will keep you compliant while flying your drone responsibly. This knowledge can save you from unforeseen liabilities as well as protect your investment in equipment and technology.

Types of Coverage Available for Drones

When it comes to drone insurance, understanding the types of coverage available is crucial. There are several options tailored to different needs.

Liability coverage is often a top priority. It protects you if your drone causes damage to someone else’s property or injures a person during operation. This can be essential for commercial users who face higher risks.

Hull insurance covers physical damage to your drone itself, whether from accidents, crashes, or even theft. If your equipment is damaged beyond repair, this type of policy ensures you’re not left high and dry financially.

There’s also personal injury liability coverage. This addresses legal fees and medical expenses stemming from injuries caused by your drone operations.

Some policies offer additional benefits like loss of income protection for commercial pilots unable to operate due to damages. Be sure to assess what fits best with how you use your drone and what assets you want protected.

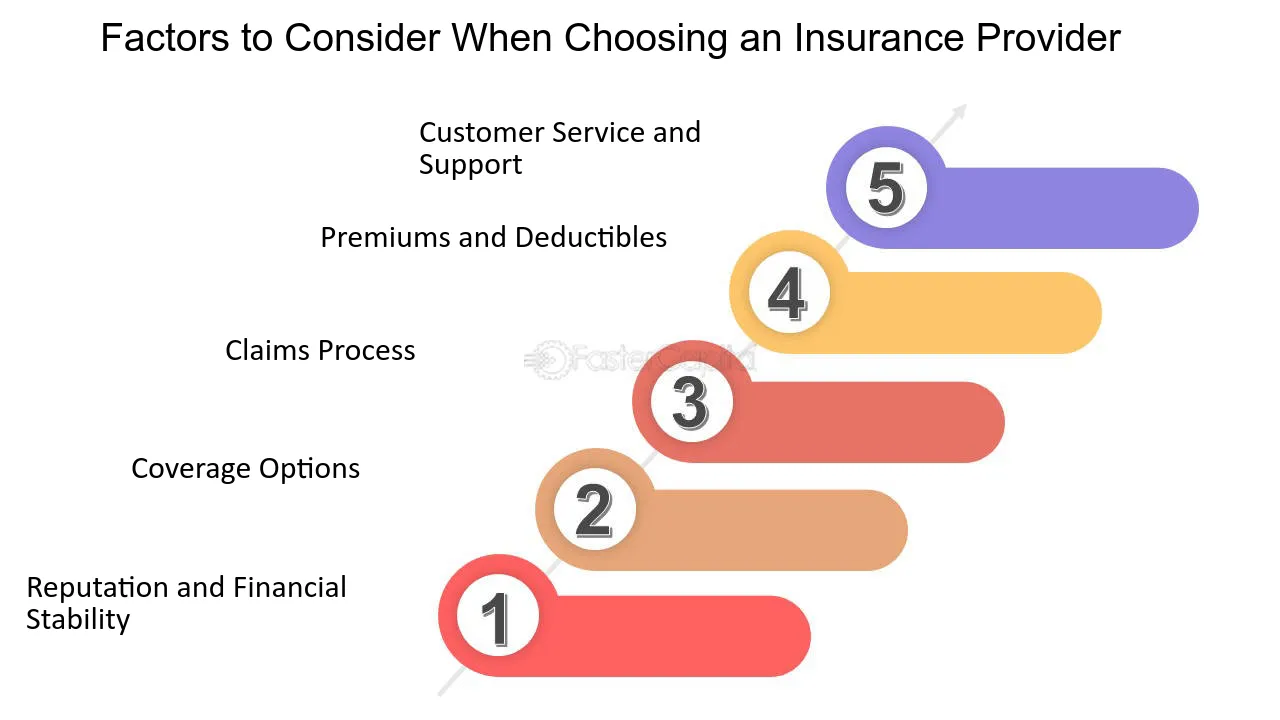

Factors to Consider When Choosing a Drone Insurance Policy

Choosing the right drone insurance policy can feel overwhelming. Start by assessing your specific needs based on how you use your drone. Commercial users might require different coverage compared to hobbyists.

Next, consider the type of drones you own. Larger or more expensive models often demand higher limits and specialized coverage options.

Review the extent of liability coverage included in the policy. This is crucial as it protects against third-party damage or injuries that could arise during operations.

Don’t overlook deductibles—higher deductibles can lower premiums but may lead to larger out-of-pocket expenses when claiming.

Evaluate customer reviews and claims processes for various insurers. A provider with a strong reputation for customer service will make all the difference when navigating claims efficiently after an incident occurs.

Understanding Exclusions and Limitations

When it comes to drone insurance, understanding exclusions and limitations is vital. These terms define what your policy does not cover, which can significantly impact your protection.

Common exclusions include damage caused by reckless flying or flying in restricted airspace. If you’re using the drone for activities outside of its intended use, you may also find yourself without coverage.

Limitations often pertain to specific situations or conditions under which a claim might be denied. For instance, certain policies may have restrictions on flying during adverse weather conditions.

It’s crucial to read the fine print carefully. Knowing these details helps you avoid unexpected surprises when filing a claim after an incident occurs. Always ask your insurance provider about any unclear aspects related to exclusions and limitations before finalizing your policy.

How to File a Claim for Drone Insurance

Filing a claim for drone insurance can seem daunting, but it doesn’t have to be. Start by gathering all necessary documentation. This includes your policy number, flight logs, and any evidence related to the incident—like photos or videos.

Next, contact your insurer as soon as possible. Most companies provide a dedicated claims hotline or online portal for reporting incidents. Be prepared to explain what happened in detail.

After you’ve submitted your claim, keep track of its status. Insurers may require additional information or clarification during their investigation process.

Remember that timely communication is crucial. Respond promptly to requests from your insurance company; delays could impact the outcome of your claim.

Stay organized throughout this process. Keeping copies of all correspondence will help if disputes arise later on regarding coverage decisions or payouts.

Importance of Staying Updated with Changing Regulations

The drone industry is rapidly evolving, and so are the regulations governing it. Staying informed about these changes is crucial for every operator.

New laws can emerge based on safety concerns or technological advancements. Ignoring updates may leave you at risk of violations that could lead to hefty fines.

Regulatory bodies like the FAA frequently revise guidelines. These adjustments might affect your flight operations, insurance requirements, or even where you can legally fly.

Furthermore, local jurisdictions often implement their own rules. What’s acceptable in one state might not be permissible in another.

Maintaining awareness allows you to adapt quickly and protect yourself from liabilities. Regularly checking official sources ensures you’re compliant with the latest standards while safeguarding your investment in both your equipment and business endeavors.

Conclusion: Protecting Your Investment and Ensuring Compliance

Investing in drone insurance is more than a smart financial decision; it’s a necessity for anyone operating these innovative devices. Not only does it protect your investment, but it also ensures compliance with legal requirements that are constantly evolving.

Understanding the specific regulations governing your area can save you from costly penalties and legal issues. Each type of coverage offers unique benefits tailored to different operational needs, whether you’re using drones for commercial purposes or recreational activities.

As you navigate the complexities of choosing a policy, consider factors like coverage limits, exclusions, and claims processes. This diligence will help you find the right fit while safeguarding yourself against unforeseen circumstances.

Staying informed about updates in legislation and industry standards is crucial as well. The world of drone operation is fast-paced, with rules changing frequently to keep up with technological advancements.

Prioritize protecting both your assets and your peace of mind by ensuring you have adequate drone insurance that meets all necessary legal standards. Your aerial adventures deserve nothing less than comprehensive protection.

Other Links:

Cyber Insurance vs. Cybersecurity: Why You Need Both for Complete Protection

Cyber Attacks on the Rise: How Cyber Insurance Can Safeguard Your Company

The Essential Guide to Cyber Insurance for Small Businesses in 2024

Drone Filming? Here’s Why You Need Specialized Insurance for Your Next Big Project