For many homeowners, mortgage insurance can feel like a necessary but burdensome expense, particularly when interest rates and housing prices fluctuate. Fortunately, refinancing your mortgage can be a strategic option to reduce or eliminate mortgage insurance costs. In this blog post, we will explore when refinancing with Private Mortgage Insurance (PMI) makes sense, how to refinance your mortgage to remove mortgage insurance, and provide a step-by-step guide for homeowners considering this option.

Understanding Mortgage Insurance

What is Mortgage Insurance?

Mortgage insurance protects lenders against the risk of borrower default. It is usually required when the borrower makes a down payment of less than 20% of the home’s purchase price. There are two main types of mortgage insurance:

- Private Mortgage Insurance (PMI): Required for conventional loans, PMI protects the lender and can be canceled when the borrower has paid down enough of the loan or when the property value appreciates sufficiently.

- FHA Mortgage Insurance Premium (MIP): Required for FHA loans, MIP includes both upfront and monthly premiums, which are generally more costly than PMI.

While mortgage insurance can help borrowers qualify for a loan with a lower down payment, it can also add significant costs to monthly payments.

Why Consider Refinancing?

Refinancing can provide a fresh opportunity to lower your mortgage payments, access better interest rates, and—most importantly—remove mortgage insurance. Homeowners often consider refinancing for various reasons, including:

- Lower Interest Rates: If market interest rates drop significantly since you secured your original mortgage, refinancing could save you money.

- Increased Home Equity: If your home has appreciated in value, you may have built enough equity to eliminate PMI.

- Better Loan Terms: Refinancing can allow you to switch to a more favorable loan structure (e.g., changing from an adjustable-rate mortgage to a fixed-rate mortgage).

Understanding the benefits of refinancing is crucial in deciding whether to proceed with the process.

Refinancing with PMI: When Does It Make Sense?

While PMI can feel burdensome, there are specific situations where refinancing with PMI may still make sense for homeowners. Here are some factors to consider:

1. Interest Rate Reduction

If the interest rates in the market have dropped significantly since you obtained your mortgage, it may make sense to refinance—even if it comes with PMI. Lowering your interest rate can result in significant monthly savings, and if the savings exceed the cost of PMI, refinancing can still be advantageous.

2. Short-Term Plans

If you plan to stay in your home for only a short period, refinancing might be worth it. You may accept PMI temporarily if it allows you to secure a more favorable interest rate that saves you money on your monthly payments.

3. Change in Financial Situation

If your financial situation has improved—such as a higher credit score or increased income—refinancing may offer better loan terms that can offset the cost of PMI. This change can make PMI more manageable.

4. Increased Property Value

If your home’s value has appreciated, you might have enough equity to refinance without needing PMI. In this case, refinancing becomes a strategic move to eliminate mortgage insurance altogether.

How to Refinance Your Mortgage and Remove Mortgage Insurance

Removing mortgage insurance through refinancing can be a straightforward process, provided you meet certain criteria. Here’s how to go about it:

Step 1: Determine Your Home Equity

To eliminate PMI through refinancing, you typically need at least 20% equity in your home. To calculate your equity:

- Get a Current Appraisal: Hire a professional appraiser to assess your home’s current market value.

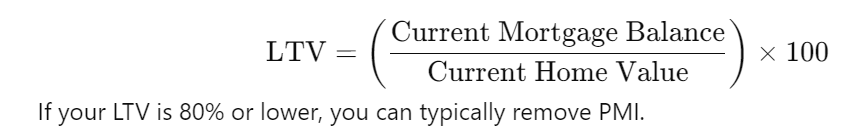

- Calculate Your Loan-to-Value Ratio (LTV): Use the formula:

Step 2: Shop for Lenders

Research and compare lenders to find the best refinance rates and terms. Consider factors such as:

- Interest Rates: Lower rates can lead to substantial savings.

- Fees and Closing Costs: Compare the total costs of refinancing.

- Lender Reputation: Read reviews and ratings from other homeowners.

Step 3: Gather Documentation

Prepare your financial documents for the refinancing application, including:

- Income Verification: Pay stubs, W-2 forms, or tax returns.

- Credit Report: Review your credit score and address any issues.

- Homeowner’s Insurance: Proof of current insurance coverage.

Step 4: Apply for the Refinance

Submit your refinance application to the chosen lender. They will assess your application, including your creditworthiness and the value of your home. Be prepared for an appraisal and possibly a home inspection.

Step 5: Close the Loan

If approved, you will receive a closing disclosure detailing the new loan terms and costs. Review it carefully before signing. Closing on your new mortgage will eliminate the old mortgage—and with it, the PMI if your equity is sufficient.

Refinance to Lower Your PMI: A Step-by-Step Guide for Homeowners

If you’re not quite ready to eliminate your mortgage insurance but want to lower your PMI premiums, follow these steps:

Step 1: Review Your Current Mortgage Terms

Take a close look at your existing mortgage terms to understand the current PMI rate you’re paying and the equity in your home.

Step 2: Check Current Market Rates

Monitor current mortgage rates to determine whether refinancing is beneficial. A drop in rates could warrant the move.

Step 3: Calculate Potential Savings

Before refinancing, calculate how much you could save by reducing your interest rate and potentially lowering your PMI. Use an online mortgage calculator to estimate monthly payments and savings.

Step 4: Get a Home Appraisal

If your home has appreciated in value since your original purchase, get an appraisal. This will help confirm whether you have sufficient equity to qualify for a refinance without PMI.

Step 5: Approach Your Lender

Talk to your current lender about your options for refinancing and express your desire to lower your PMI. They may provide insights on how much you could save.

Step 6: Complete the Application Process

Once you’ve selected a lender, gather the necessary documentation and submit your refinance application. Be prepared for potential fees associated with the process.

Step 7: Close on Your New Loan

If your application is approved, review the closing documents carefully, and then close on the new mortgage. The goal is to lock in a lower interest rate and reduce your PMI payments.

Conclusion

Refinancing your mortgage can be an effective way to remove or lower mortgage insurance, allowing homeowners to save money over time. Whether you are looking to take advantage of lower interest rates, have improved your financial situation, or want to capitalize on increased home equity, understanding how mortgage insurance interacts with refinancing is crucial.

As you consider your options, weigh the costs and benefits carefully, and don’t hesitate to consult with mortgage professionals to guide you through the process. By making informed decisions, you can navigate the complexities of mortgage insurance and refinancing and achieve your financial goals more effectively.

Check Out:

Cost-Saving Tips on Mortgage Insurance: A Comprehensive Guide

Mortgage Insurance for High-Risk Borrowers: What You Need to Know and How to Get Approved

Mortgage Insurance Tax Deductions

Mortgage Insurance for Veterans (VA Loans)