In today’s digital landscape, the threat of cyber attacks looms larger than ever. It’s not just large corporations that are at risk; small businesses are increasingly becoming prime targets as well. With hackers developing more sophisticated methods to breach security systems, companies must stay vigilant and proactive.

Imagine waking up to find your sensitive data compromised or your business operations halted due to a ransomware attack. The consequences can be devastating—financial losses, damage to reputation, and even legal repercussions. As cyber threats escalate, so does the importance of being prepared.

This is where cyber insurance comes into play. It offers a safety net for businesses navigating these treacherous waters. But what exactly does it entail? Let’s explore how this essential coverage can safeguard your company against rising cyber risks.

The Growing Threat of Cyber Attacks

The digital landscape is evolving rapidly, but so are the threats lurking within it. Cyber attacks are becoming more sophisticated and frequent. Organizations of all sizes face a constant barrage of potential breaches.

Ransomware, phishing schemes, and data theft have surged in recent years. These tactics exploit vulnerabilities in both technology and human behavior. As remote work increases, hackers target unprotected networks more than ever.

Small businesses often feel invincible due to their size but aren’t immune to these dangers. In fact, they can be prime targets because they may lack robust security measures.

The financial implications can be devastating. A single breach could lead to significant losses or even closure for some companies.

Staying ahead requires vigilance and preparation against this growing threat that shows no signs of slowing down anytime soon.

What is Cyber Insurance?

Cyber insurance is a specialized policy designed to protect businesses from the financial fallout of cyber incidents. These events can range from data breaches to ransomware attacks, which increasingly threaten organizations across all sectors.

This type of insurance covers various expenses incurred due to cyber threats. From legal fees and customer notification costs to public relations efforts aimed at damage control, it offers essential support during crises.

Moreover, policies often include risk management services. Insurers may provide resources for assessing vulnerabilities or implementing better security practices.

As digital landscapes evolve rapidly, having this safety net becomes crucial for business continuity. Cyber insurance provides peace of mind by ensuring that companies are not left stranded in the aftermath of an attack.

How Does Cyber Insurance Work?

Cyber insurance functions as a safety net for businesses facing digital risks. When a cyber incident occurs, the insured company can file a claim with their provider. This initiates an assessment of damages and losses.

Once the claim is approved, the insurer steps in to cover various expenses. These may include costs associated with data recovery, system repairs, and legal fees stemming from breaches.

Additionally, many policies offer resources for crisis management. This includes access to cybersecurity experts who can help navigate the aftermath of an attack.

The process emphasizes swift response and mitigation strategies to minimize further damage. Companies gain peace of mind knowing they have financial backing during challenging times.

Understanding the specifics of your policy is crucial for effective coverage. Tailoring it to fit your business’s unique needs ensures adequate protection against evolving threats.

Types of Coverage Offered by Cyber Insurance

Cyber insurance policies offer a variety of coverage options to address different needs. First, there’s data breach coverage. This helps with the costs associated with notifying affected customers and managing public relations.

Next, business interruption coverage is crucial. If your operations are disrupted due to a cyber attack, this can replace lost income during downtime.

Another important aspect is malware and hacking response expenses. This type of coverage assists in forensic investigations and recovery efforts after an incident.

Legal liability protection comes into play when you face lawsuits stemming from breaches or failures in data security. It covers legal fees and settlements.

Identity theft protection offers support for both individuals within your company and customers who may be affected by stolen personal information.

Each type serves a specific purpose, ensuring that businesses have comprehensive support tailored to their unique risks.

Benefits of Having Cyber Insurance for Your Company

Cyber insurance offers a vital safety net for businesses navigating the digital landscape. It provides financial protection against the costly repercussions of cyber incidents, from data breaches to ransomware attacks.

With coverage in place, companies can focus on recovery rather than worrying about crippling expenses. Cyber insurance often covers legal fees and regulatory fines that may arise after a breach.

Additionally, having a policy can enhance your company’s reputation. Stakeholders tend to view insured organizations as more responsible and trustworthy.

Many policies also include access to expert resources. This means you have professionals ready to assist with incident response and crisis management when needed most.

Investing in cyber insurance is not just about risk mitigation; it’s about fostering resilience in an increasingly connected world. Being prepared helps maintain continuity even during challenging times.

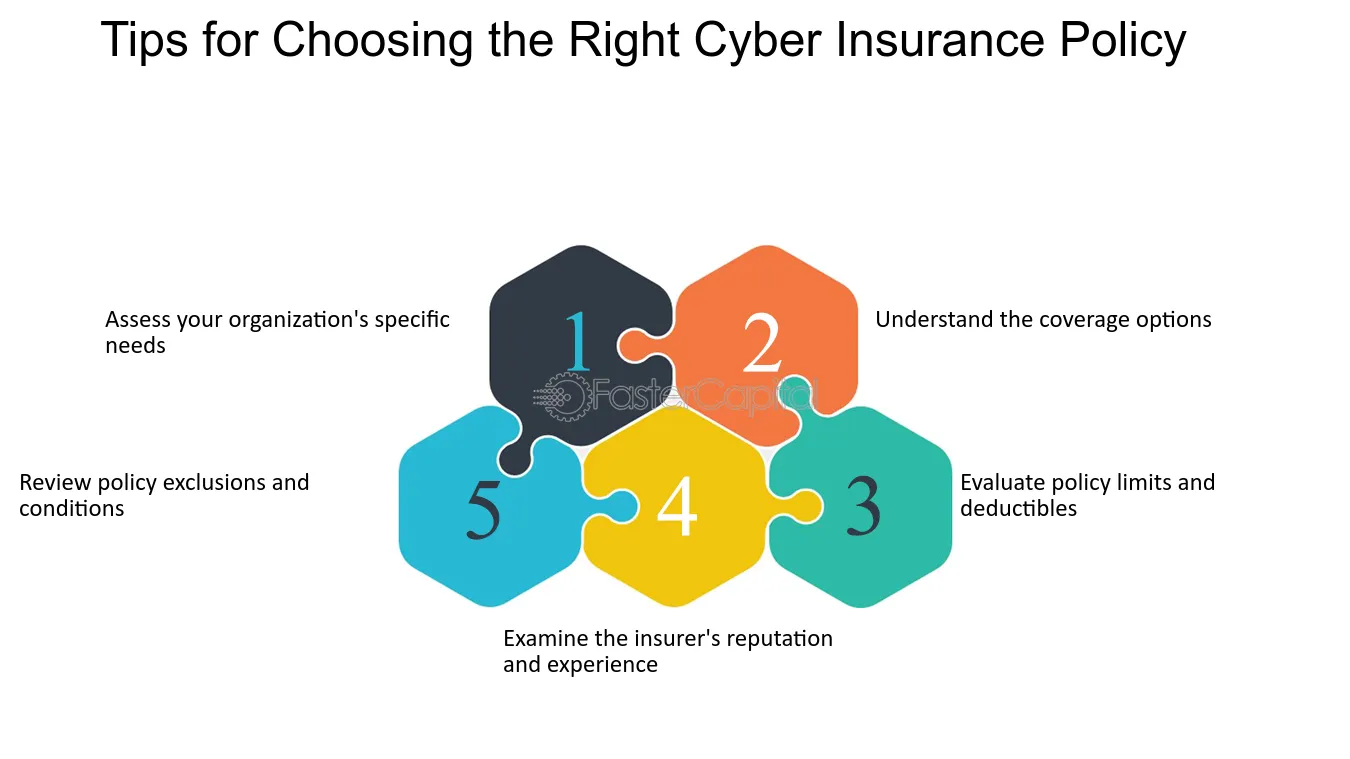

Tips for Choosing the Right Cyber Insurance Policy

When selecting a cyber insurance policy, start by assessing your company’s specific needs. Different organizations face unique risks based on their industry and size.

Next, evaluate the coverage options available. Look for policies that include data breach response costs, business interruption losses, and liability coverage.

Don’t overlook the limits of each policy. Ensure the coverage amounts align with potential financial impacts from a cyber incident.

It’s also wise to understand any exclusions in the policy. Knowing what’s not covered can save you from unexpected surprises down the line.

Engage with an experienced broker who specializes in cyber insurance. Their insights can guide you toward suitable options tailored to your risk profile.

Review your policy regularly as your business evolves. Keep it current to reflect changes in technology or operations that could affect your cybersecurity landscape.

Conclusion and Final Thoughts

Cyber attacks have become an unfortunate reality for businesses of all sizes. As threats continue to evolve and grow, it’s essential for companies to take proactive steps in safeguarding their assets. Cyber insurance plays a critical role in this strategy, providing financial protection and support during cyber incidents.

Having the right policy can mean the difference between recovery and devastation. With various coverage options available, businesses can tailor their cybersecurity insurance to meet their unique needs. This not only helps mitigate risks but also demonstrates a commitment to protecting sensitive data.

Choosing the right policy requires careful consideration of your company’s specific circumstances. Assessing potential vulnerabilities and understanding what coverage is necessary should be prioritized.

Investing in cyber insurance isn’t just about compliance; it’s about ensuring peace of mind in a digital landscape fraught with danger. Safeguarding your company against cyber threats is no longer optional—it’s imperative for survival in today’s interconnected world.

Other Links:

The Essential Guide to Cyber Insurance for Small Businesses in 2024

Drone Filming? Here’s Why You Need Specialized Insurance for Your Next Big Project

The Growing Need for eSports Insurance: Protecting Gamers and Events in 2024

How Parametric Insurance is Saving Businesses from Natural Disasters