Your credit score plays a pivotal role in many aspects of your financial life, from securing a mortgage to qualifying for a personal loan. However, one lesser-known area where credit scores have a significant impact is insurance rates. Insurers use your credit score—or a version of it called an “insurance credit score”—as a factor in determining your premiums for various policies, including auto, home, and renters insurance.

Understanding how your credit score influences your insurance rates can empower you to make informed decisions and potentially save money. This article explores the relationship between credit scores and insurance rates, explains why insurers consider your credit, and offers actionable tips to improve your score and lower your premiums.

What Is an Insurance Credit Score?

Before diving into how your credit score affects insurance rates, it’s essential to understand the concept of an insurance credit score.

An insurance credit score is a numerical representation of your creditworthiness, specifically tailored for insurance purposes. Insurers use this score to predict the likelihood that a policyholder will file a claim. While it’s derived from your standard credit report, an insurance credit score focuses on certain financial behaviors rather than the broader metrics used for lending decisions.

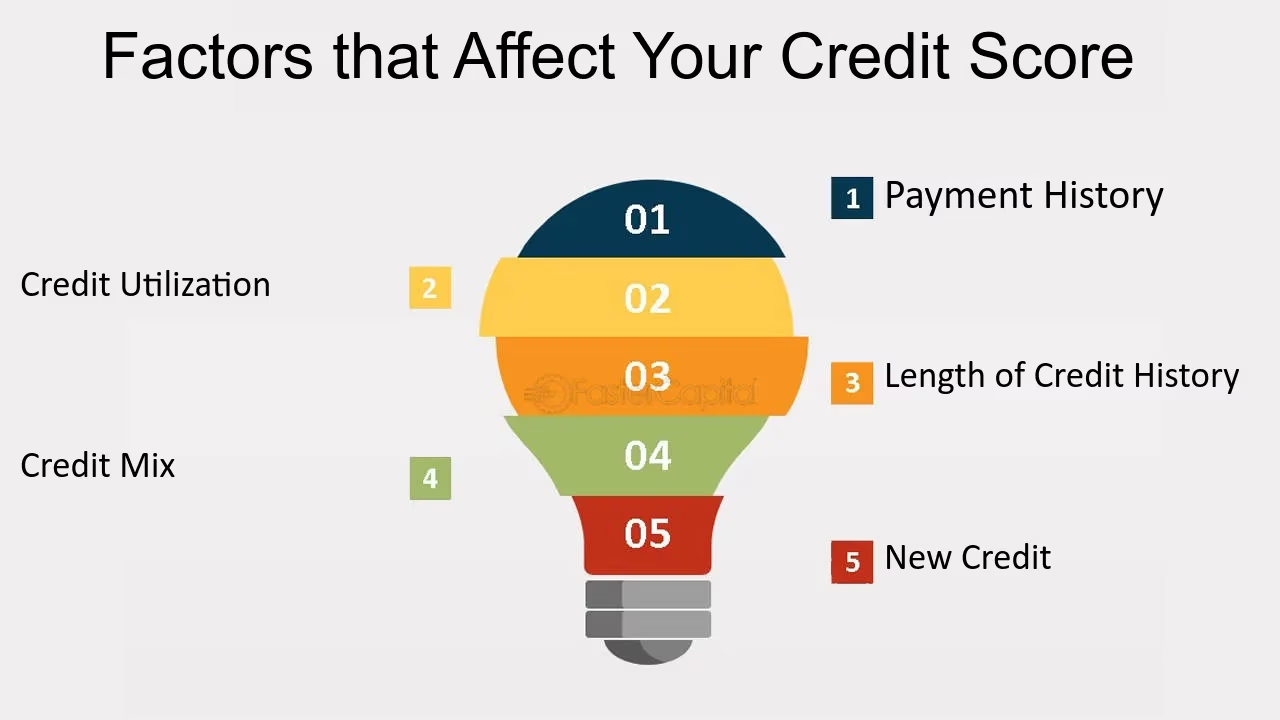

Key factors influencing your insurance credit score include:

- Payment history (e.g., on-time or late payments).

- Credit utilization (how much of your available credit you’re using).

- Length of credit history.

- Types of credit (e.g., credit cards, loans).

- Number of recent inquiries on your credit report.

Why Do Insurers Use Credit Scores?

Insurance companies use credit scores because they believe there is a statistical correlation between credit behavior and the likelihood of filing claims. While this practice has been debated, studies show that individuals with lower credit scores tend to file more claims or incur higher claim costs compared to those with higher scores.

By incorporating credit scores into their risk assessment models, insurers can:

- Predict Risk Accurately: Credit scores help insurers identify potential financial risks among policyholders.

- Offer Competitive Rates: Lower-risk customers (those with higher credit scores) may receive lower premiums, while higher-risk customers may pay more.

- Ensure Fair Pricing: Credit scores allow insurers to distribute risk more evenly across their customer base.

How Your Credit Score Affects Insurance Rates

- Auto Insurance

Your credit score has a direct impact on auto insurance rates in most states. Insurers use it to assess how likely you are to file a claim or incur high repair costs.

- High Credit Score: If you have excellent credit, you’re more likely to qualify for lower premiums.

- Low Credit Score: A poor credit score may result in significantly higher premiums, sometimes double or triple the rate offered to someone with excellent credit.

Exceptions: Some states, including California, Hawaii, and Massachusetts, prohibit the use of credit scores in determining auto insurance rates.

- Home Insurance

Home insurance providers often factor in your credit score when setting premiums. A good credit score suggests financial responsibility, which insurers may interpret as a lower likelihood of filing frequent or excessive claims.

- High Credit Score: You may enjoy lower premiums and better coverage options.

- Low Credit Score: A poor score might lead to higher premiums or even difficulty securing coverage.

- Renters Insurance

Although renters insurance tends to be less expensive than auto or home insurance, your credit score can still affect the premium. Renters with high credit scores are often seen as less risky, resulting in lower premiums.

Credit Score Tiers and Their Impact on Insurance Rates

Insurers often categorize policyholders into credit score tiers, which influence the rates offered:

- Excellent (750+): Eligible for the lowest premiums and the best discounts.

- Good (700–749): Competitive rates, but slightly higher than those with excellent credit.

- Fair (650–699): Moderate rates, with fewer discounts available.

- Poor (600–649): Higher premiums and potentially limited options.

- Very Poor (<600): Significantly higher premiums and possible denial of coverage.

How to Improve Your Credit Score to Lower Insurance Rates

- Pay Bills on Time

Payment history is a major factor in both your credit score and your insurance credit score. Set up reminders or automatic payments to ensure you never miss a due date. - Reduce Credit Card Balances

Aim to keep your credit utilization below 30%. Paying down balances can boost your score and demonstrate financial responsibility. - Limit New Credit Inquiries

Applying for too much credit in a short period can negatively impact your score. Be strategic about when and why you apply for new credit. - Monitor Your Credit Report

Regularly check your credit report for errors or inaccuracies that could harm your score. You’re entitled to one free credit report annually from each of the three major bureaus (Equifax, Experian, and TransUnion). - Build a Long Credit History

The length of your credit history contributes to your score. Avoid closing old accounts, as they help establish a longer credit timeline.

State Regulations on Credit Scores and Insurance

As mentioned earlier, some states have implemented laws restricting or prohibiting the use of credit scores in determining insurance rates. If you live in one of these states, your credit score may have little to no impact on your premiums:

- California

- Hawaii

- Massachusetts

- Michigan (auto insurance only)

Check your state’s regulations to understand how insurers use credit scores in your area.

Additional Factors Insurers Consider

While your credit score is significant, it’s not the only factor that influences insurance rates. Insurers also evaluate:

- Driving history (for auto insurance).

- Claims history.

- Location.

- Type and value of the insured property.

A strong credit score can offset some of these factors, resulting in better overall rates.

Conclusion

Your credit score is a powerful tool that affects various aspects of your financial life, including insurance rates. By understanding how insurers use your credit score and taking steps to improve it, you can secure better premiums and save money.

Whether you’re shopping for auto, home, or renters insurance, maintaining a good credit score not only reflects your financial responsibility but also opens the door to more affordable and comprehensive coverage. Use this knowledge to make informed decisions and take control of your insurance costs.

More:

The Best Insurance Comparison Tools: A Comprehensive Guide to Making Smart Choices

How to Compare Insurance Quotes and Choose the Best Policy: A Step-by-Step Guide

NFT and Cryptocurrency Insurance: Protecting Digital Assets in a Digital World

Mortgage Insurance and Refinancing: A Comprehensive Guide