As a pet owner, you know how much joy and companionship your furry friend brings into your life. But along with all the cuddles and tail wags comes the responsibility of keeping them healthy. Veterinary bills can pile up quickly, leaving many pet owners wondering if there’s a safety net to help ease those financial burdens. Enter pet insurance—a topic that’s gaining traction in 2024.

Is it really worth investing in? Does it provide enough coverage for unexpected medical emergencies or routine care? With so many options available, navigating this landscape can feel overwhelming. Let’s dive deep into what pet insurance entails so that you can make an informed decision for your beloved companion.

What Does Pet Insurance Cover?

Pet insurance can vary widely, but it generally covers a range of medical expenses. Most plans include routine check-ups, vaccinations, and preventive care.

Emergency visits are also commonly included. If your furry friend faces an unexpected illness or injury, pet insurance can help alleviate financial stress. Surgical procedures often fall under coverage as well.

Some policies extend to chronic conditions like diabetes or arthritis. This means you won’t have to bear the entire burden for ongoing treatments.

Additionally, many insurers offer options for alternative therapies such as acupuncture or physical rehabilitation.

It’s important to note that not all services are covered equally across different providers. Always read the fine print before making a decision about what fits your pet’s needs best.

The Cost of Pet Insurance

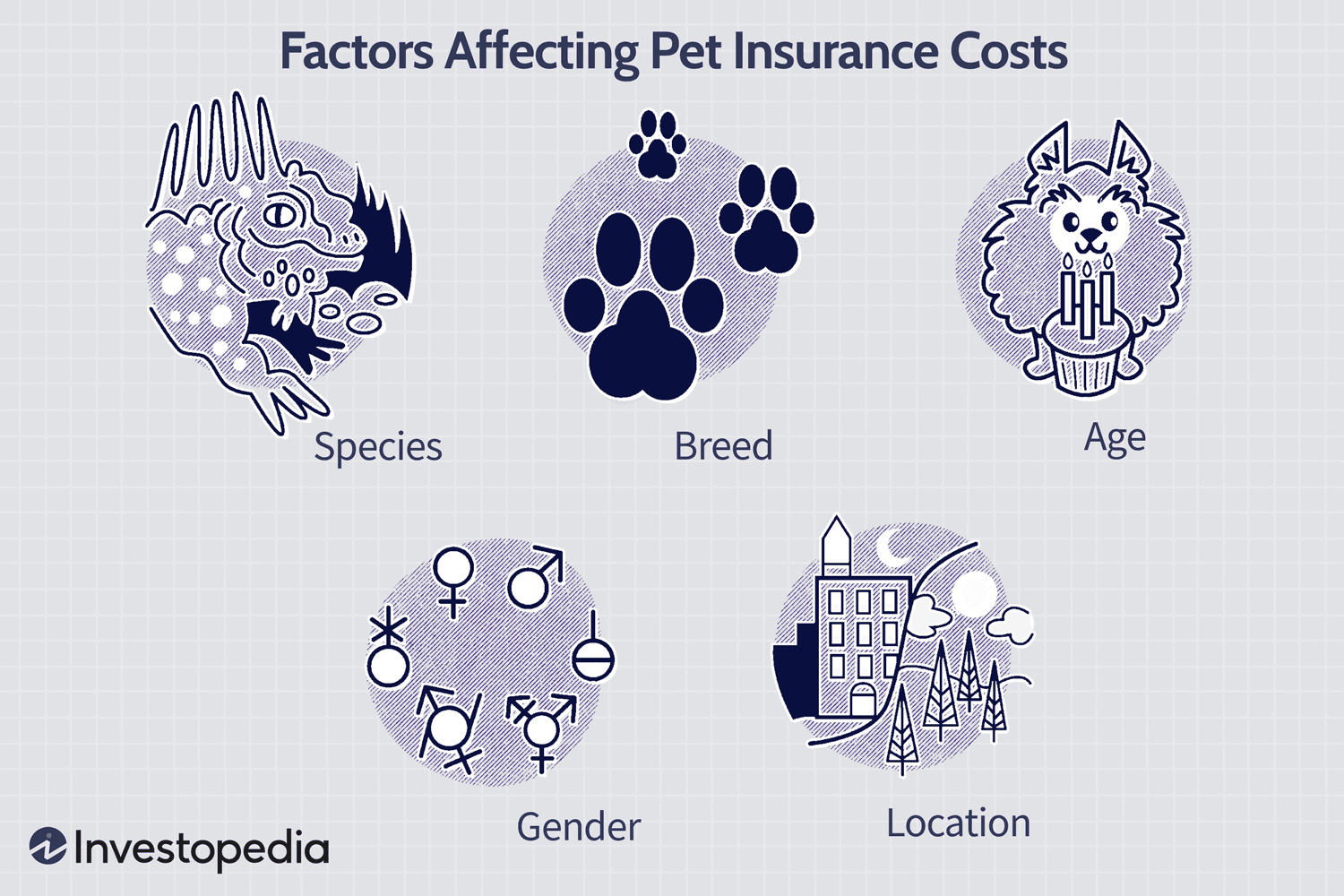

The cost of pet insurance varies widely. Factors like your pet’s age, breed, and health history play a significant role in determining premiums. Younger pets often have lower rates compared to older ones.

On average, monthly premiums can range from $30 to over $100. Dogs typically cost more than cats due to their larger size and higher risk for certain conditions.

Deductibles also impact overall expenses. Policies may have annual deductibles that you must meet before coverage kicks in. This means you’ll need to budget for some out-of-pocket costs initially.

Don’t forget about co-pays and limits on reimbursements. Some plans cover only 70% or 80% of eligible expenses after the deductible is met.

Understanding these costs helps you choose wisely when shopping for pet insurance options tailored to fit your financial situation while ensuring your furry friend gets the care they deserve.

Factors to Consider When Choosing a Pet Insurance Plan

When selecting a pet insurance plan, start by assessing your pet’s specific needs. Consider their breed, age, and any pre-existing conditions. Some breeds are more prone to certain health issues, which can influence coverage options.

Next, examine the policy details closely. Look for exclusions and limitations that may affect you later on. Some plans cover only accidents or illnesses while others might include wellness visits.

Don’t forget about premiums and deductibles. A lower monthly payment might seem attractive but could come with higher out-of-pocket costs when you file a claim. Compare different plans to find the right balance.

Check customer reviews and service ratings. Reliable support during stressful times is invaluable when dealing with your furry family member’s health concerns.

Is Pet Insurance Worth It?

Pet insurance can be a lifesaver for many pet owners. Unexpected vet bills can quickly add up, especially in emergencies. With coverage, you might find some peace of mind knowing that financial barriers to critical care are reduced.

However, it’s essential to consider your specific situation. Some pets may rarely need medical attention, while others with chronic conditions could incur significant costs. The value of insurance often depends on your pet’s health history and lifestyle.

Another point worth pondering is the age of your pet. Younger animals typically have fewer health issues but may still benefit from early coverage against accidents or unforeseen illnesses.

Compare various plans carefully before making a decision. Each policy varies significantly in terms of premiums and what they cover, so do your homework to ensure you’re getting the best fit for both you and your furry friend.

Alternatives to Traditional Pet Insurance

For pet owners seeking alternatives to traditional pet insurance, several options exist that can provide peace of mind without the high premiums. One popular choice is a wellness plan. These plans often cover routine care like vaccinations and check-ups, making it easier to manage everyday expenses.

Another alternative is setting up a dedicated savings account for your pet’s health needs. By contributing regularly, you create a financial cushion for unexpected vet bills without the limitations of an insurance policy.

Pet discount programs also offer significant savings on veterinary services and medications. Many vets partner with these programs, allowing you to reduce costs while maintaining quality care.

Consider crowdfunding platforms or community support networks designed specifically for pets in need of medical assistance. They can be invaluable if your fur baby faces an expensive treatment unexpectedly. Each option presents unique benefits tailored to different lifestyles and budgets.

Conclusion: Making the Best Decision for Your Fur Baby

Deciding whether pet insurance is the right choice for you and your furry friend requires careful consideration. Every pet owner’s situation is unique, influenced by factors such as breed, age, and overall health of their beloved companion.

It’s essential to weigh the potential benefits against the costs involved in maintaining a policy. For some, having that safety net can bring peace of mind during unexpected veterinary visits or emergencies. Others may find that setting aside funds for medical expenses works better for their lifestyle.

Exploring alternatives like wellness plans or savings accounts can also provide viable options tailored to individual needs. Remember to read reviews and ask fellow pet owners about their experiences with different providers.

Gathering all this information will help guide you toward what feels best for both you and your fur baby—ensuring they receive the care they need without unnecessary stress on your finances. Take your time making this decision; after all, it’s about securing a happy future together.

Other Links:

Securing Your Digital Wealth: The Rise of NFT and Cryptocurrency Insurance

Drone Insurance: How to Safeguard Your Investment and Stay Legal

Why Cyber Insurance is a Must-Have in 2024: Protecting Your Business from Data Breaches