When it comes to homeownership, every dollar counts, and tax deductions can significantly reduce the cost of maintaining a home. Mortgage insurance is one of those costs that can be burdensome for homeowners, especially for those who put less than 20% down on their home purchase. However, the ability to deduct mortgage insurance premiums on your taxes can help soften the financial blow. This guide will explore whether mortgage insurance is tax-deductible in 2024, how to claim these deductions, and how you can maximize your savings with tax breaks related to mortgage insurance.

Is Mortgage Insurance Tax-Deductible?

The first and most important question homeowners often ask is: Is mortgage insurance still tax-deductible in 2024? The answer is: it depends. While mortgage insurance deductions have been a valuable tax-saving tool for many years, they’ve been subject to legislative changes and temporary extensions. As of 2024, the tax deductibility of mortgage insurance premiums is still available, thanks to the most recent extension under the Further Consolidated Appropriations Act of 2020.

However, this provision is set to expire at the end of 2024 unless Congress acts to extend it again. Therefore, it’s crucial for homeowners to take advantage of this deduction while it lasts.

What Types of Mortgage Insurance Are Tax-Deductible?

The IRS allows deductions for specific types of mortgage insurance premiums paid in connection with the acquisition of your primary residence. These include:

- Private Mortgage Insurance (PMI): This is often required for conventional loans when the down payment is less than 20%.

- FHA Mortgage Insurance Premiums (MIP): These premiums are associated with loans backed by the Federal Housing Administration.

- VA Loan Funding Fees: Though VA loans don’t have traditional mortgage insurance, the funding fee associated with these loans is also tax-deductible.

- USDA Mortgage Insurance: Loans backed by the USDA also require mortgage insurance, which is deductible.

It’s important to note that these deductions apply only to insurance associated with your primary residence, not second homes or investment properties.

Income Limits for Mortgage Insurance Deductions

While mortgage insurance premiums can be deducted, not every homeowner will qualify. The IRS places income limits on eligibility for the deduction. As of 2024, the full deduction is available to taxpayers with an adjusted gross income (AGI) of $100,000 or less ($50,000 for those who file separately). If your AGI exceeds this threshold, the deduction begins to phase out. For every $1,000 over the $100,000 limit, the amount of the deduction decreases by 10%.

If your AGI exceeds $109,000 ($54,500 for separate filers), you won’t be able to claim the deduction at all.

How to Claim Mortgage Insurance Deductions on Your Taxes

Now that we’ve established that mortgage insurance can be tax-deductible, the next step is understanding how to claim these deductions when filing your taxes in 2024. The process is relatively straightforward if you follow these steps:

1. Itemize Your Deductions

Mortgage insurance premiums can only be deducted if you itemize your deductions, rather than taking the standard deduction. This is a key factor because the standard deduction increased significantly in recent years:

- $13,850 for single filers

- $27,700 for married couples filing jointly

- $20,800 for heads of household

If your total itemized deductions, including mortgage insurance premiums, exceed these amounts, it’s worth itemizing. If not, you’re better off taking the standard deduction, and you won’t be able to claim the mortgage insurance premium deduction.

2. Gather the Necessary Documents

You’ll need the following documents to claim your mortgage insurance deduction:

- Form 1098: Your mortgage lender will provide this form, typically in January. It shows how much you paid in mortgage insurance premiums during the tax year.

- Mortgage Statements: These can help verify the amounts paid if needed.

3. Use Schedule A

To claim the mortgage insurance deduction, you’ll need to file Schedule A (Form 1040). This form is used to report itemized deductions. In the section labeled “Interest You Paid,” there’s a line specifically for mortgage insurance premiums. Simply enter the total from your Form 1098.

4. Adjust for Income Limits

If your AGI is above $100,000, you’ll need to reduce the amount of the deduction. For example, if your AGI is $105,000, you would reduce the deduction by 50% because your income exceeds the limit by $5,000.

5. Claim the Deduction for Married Filing Separately

If you’re married and file separately, the income limits for the deduction are halved. Be aware that the $50,000 AGI cap for married individuals filing separately means that if your AGI exceeds this threshold, the deduction phases out faster.

Mortgage Insurance and Tax Breaks: Maximize Your Savings in 2024

Understanding mortgage insurance deductions is just one part of maximizing your tax savings in 2024. There are other ways you can optimize your tax return, especially when it comes to homeownership. Here are a few additional tax breaks related to mortgages that you should know:

1. Mortgage Interest Deduction

Along with mortgage insurance premiums, the mortgage interest deduction is one of the most valuable tax benefits for homeowners. You can deduct the interest paid on mortgage loans up to $750,000 if you purchased your home after December 15, 2017. If your loan was secured before that date, the limit is $1 million.

For many homeowners, the interest paid on a mortgage is substantial, especially in the early years of the loan. This can make itemizing deductions more worthwhile.

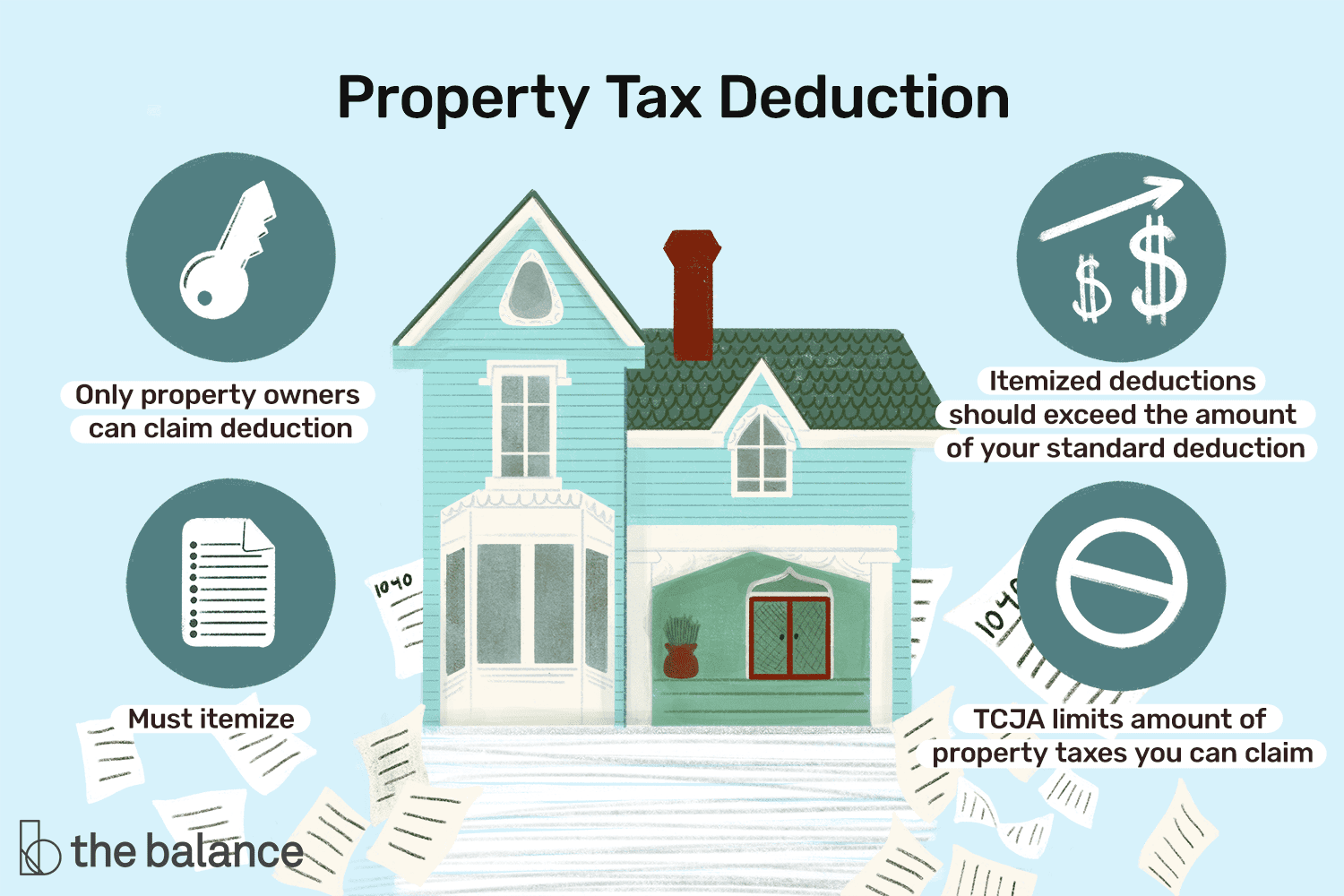

2. Property Tax Deduction

Another valuable tax deduction for homeowners is the ability to deduct state and local property taxes. The State and Local Tax (SALT) deduction allows you to deduct property taxes along with income or sales taxes. However, the deduction is capped at $10,000 ($5,000 for married filing separately).

This is particularly beneficial for homeowners in states with high property taxes, though the cap can limit the deduction for some.

3. Energy Efficiency Tax Credits

If you made energy-efficient improvements to your home, you may qualify for the Residential Energy Efficient Property Credit. This credit applies to renewable energy systems like solar panels, wind turbines, and geothermal heat pumps. The credit is worth up to 30% of the cost of these improvements and can significantly reduce your tax liability.

4. Capital Gains Exclusion on Home Sales

If you sell your primary residence, you may be able to exclude up to $250,000 in capital gains from your taxable income ($500,000 if married filing jointly). To qualify, you must have lived in the home for at least two of the five years before the sale.

This exclusion can help homeowners avoid paying taxes on the profit from their home sale, which can be substantial in today’s housing market.

Maximizing Your Mortgage Insurance Tax Deductions

While the ability to deduct mortgage insurance premiums is a valuable tax break, it’s important to be strategic in how you approach tax planning. Here are a few tips to maximize your mortgage insurance deduction and other home-related tax benefits:

- Keep Track of Your Payments: Throughout the year, keep an organized record of all your mortgage payments, including how much went toward mortgage insurance. This will make filing your taxes easier and ensure that you don’t miss out on deductions.

- Monitor Your AGI: If you’re near the $100,000 AGI threshold, consider strategies to reduce your taxable income, such as contributing to retirement accounts or using other deductions. This can help you qualify for the full mortgage insurance deduction.

- Consider Refinancing: If mortgage insurance premiums are a significant financial burden, you may want to explore refinancing options to eliminate them. Refinancing can help you avoid paying PMI or FHA mortgage insurance and still allow you to take advantage of mortgage interest deductions.

Conclusion: Take Advantage of Mortgage Insurance Deductions

Mortgage insurance can be an expensive part of homeownership, but tax deductions offer a way to offset some of these costs. As of 2024, mortgage insurance premiums remain tax-deductible, making it important for homeowners to understand how to claim this deduction and maximize their savings.

While the future of this tax deduction is uncertain, the opportunity to save on taxes is available now, so make sure to itemize your deductions and take full advantage of the benefits. With careful planning and a strategic approach to tax breaks, you can significantly reduce your tax liability and make homeownership more affordable in the long run.

Now Read:

Mortgage Insurance for Veterans (VA Loans)

Lender-Paid Mortgage Insurance (LPMI)

Mortgage Insurance for Self-Employed Borrowers

Mortgage Protection Insurance (MPI): Is It the Right Choice for Homeowners?