In a world where convenience is king, traditional car insurance models are feeling the heat. Drivers are no longer satisfied with a one-size-fits-all policy that locks them into rigid terms and high premiums. Instead, modern drivers crave flexibility and control over their coverage—enter on-demand car insurance. This innovative approach allows you to pay only for the insurance you need when you need it. Whether you’re using your vehicle occasionally or just borrowing someone else’s ride, this new model adapts to fit your lifestyle seamlessly. Get ready to explore how on-demand car insurance could revolutionize the way we think about driving protection!

The Evolution of Car Insurance

Car insurance has come a long way since its inception in the early 20th century. Back then, policies were simple and primarily focused on liability coverage. As vehicles became more sophisticated, so did the insurance products.

The post-war era saw an explosion of car ownership. Insurance companies responded by introducing comprehensive plans that covered theft, damage, and personal injury. This expansion marked a shift toward recognizing cars as essential parts of daily life.

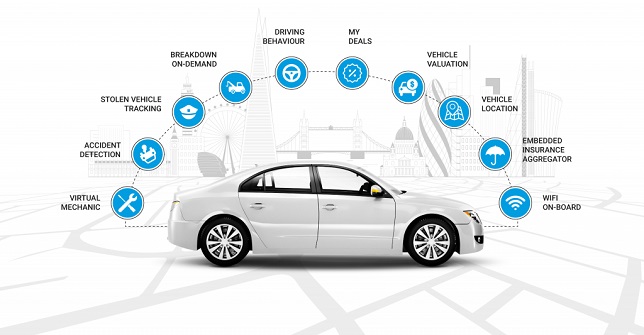

In recent decades, technology began to reshape the industry further. With advancements like telematics and mobile apps, insurers could gather data about driving habits. This led to personalized rates based on actual risk rather than guesswork.

Now we find ourselves at the crossroads of innovation with on-demand car insurance emerging as a game changer for modern drivers seeking customizable solutions tailored to their unique needs. Traditional structures are giving way to flexibility that reflects today’s fast-paced lifestyles.

What is On-Demand Car Insurance?

On-demand car insurance is a fresh approach to auto coverage that caters to the needs of modern drivers. Unlike traditional policies, this type allows you to purchase insurance only when you need it.

Picture this: You’re planning a weekend road trip or renting a vehicle for a short period. With on-demand car insurance, you can activate your policy with just a few taps on your smartphone.

It’s flexible and often more economical since you’re not paying premiums for times when your vehicle sits idle. The process is seamless, usually involving an app that lets you choose the duration and level of coverage.

This innovative model aligns perfectly with today’s fast-paced lifestyle, allowing users to enjoy peace of mind without committing long-term financial resources. It truly reflects how technology continues transforming our everyday experiences in convenient ways.

Benefits of On-Demand Car Insurance

On-demand car insurance offers unparalleled flexibility for today’s drivers. You can tailor coverage to your specific needs, whether it’s for a quick trip or an extended road adventure.

This type of insurance is often more cost-effective. You only pay for the time you need, which means no wasted money on policies that don’t fit your lifestyle.

Additionally, the convenience factor cannot be ignored. With just a few taps on your smartphone, you can adjust coverage or purchase short-term protection in minutes.

Another standout benefit is transparency. Many providers offer clear pricing and easy-to-understand terms, eliminating confusion about what’s covered.

On-demand options cater to various driving habits—ideal for occasional drivers or those who use ride-sharing services. It’s all about empowering users with control over their own insurance experience.

How to Get On-Demand Car Insurance

Getting on-demand car insurance is simpler than you might think. First, download an app or visit a website of a provider that offers this flexible coverage.

Next, create an account by entering your basic information. This usually includes your name, address, and vehicle details. Some platforms may ask for driving history as well.

Once you’re set up, customize your coverage based on your needs. You can choose how long you want the policy to last—whether it’s just for a day or extended over several months.

Before finalizing everything, review the pricing options. Many companies offer competitive rates that adjust according to usage.

After you confirm all details and make payment through secure channels, you’ll receive instant proof of insurance via email or within the app itself. It’s quick and efficient!

Top On-Demand Car Insurance Companies

When it comes to on-demand car insurance, several companies are leading the charge with innovative solutions.

Metromile is one standout. This provider offers pay-per-mile coverage, perfect for infrequent drivers. The app tracks mileage and adjusts premiums accordingly, making it a budget-friendly choice.

Another notable player is Trov. They specialize in insuring specific items within your vehicle, whether it’s a laptop or camera gear. You can turn coverage on and off as needed—ideal for those who travel light.

Then there’s Slice, which caters primarily to rideshare drivers. Their flexible policies accommodate sporadic driving needs seamlessly.

There’s Root Insurance. By using data from your smartphone to analyze driving behavior, they provide personalized rates based on actual performance rather than traditional metrics.

These companies are reshaping the landscape of auto insurance with tailored solutions that resonate with modern consumers’ lifestyles.

Common Misconceptions About On-Demand Car Insurance

Many people assume that on-demand car insurance is only for infrequent drivers. In reality, it caters to a broad audience. Whether you drive daily or just occasionally, this flexible coverage can meet your needs.

Another misconception is that on-demand policies lack comprehensive protection. However, many providers offer robust options that include liability, collision, and even uninsured motorist coverage.

Some think the pricing model is confusing or hidden fees are common. Most companies provide transparent pricing structures. You pay only for what you use—nothing more.

Additionally, there’s a belief that claims processes are complicated with these policies. On-demand insurers often streamline their services through apps and online tools for ease of access and efficiency.

Some worry about the reliability of these newer companies compared to traditional insurers. Many on-demand options are backed by established firms committed to quality service and consumer trust.

The Future of Flexible Coverage for Modern Drivers

The landscape of car insurance is shifting. Modern drivers crave flexibility, and on-demand car insurance fits the bill perfectly. This innovative model allows you to tailor your coverage based on your needs, whether you’re driving daily or just occasionally.

As technology continues to evolve, so do customer expectations. The future will likely see even more customization options, allowing policyholders to adapt their plans in real-time. Imagine adjusting your coverage with a simple tap on your smartphone when taking a road trip or switching off protection for days when your vehicle stays parked.

Moreover, as telematics becomes more widespread, insurers can offer personalized rates based on actual driving behavior. Safe drivers may see significant savings while those who drive less frequently could pay only for the coverage they use.

With environmental concerns growing, we might also witness an increase in eco-friendly policies tailored for electric and hybrid vehicles. These would not only provide necessary protection but also incentivize greener choices among consumers.

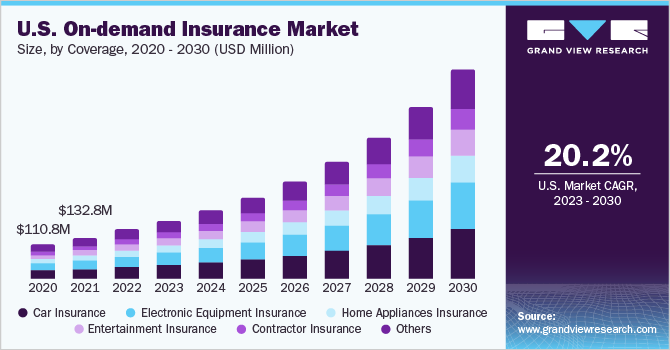

On-demand car insurance represents a pivotal shift towards user-centric services in the industry. As it gains traction, this approach promises greater convenience and affordability for all types of drivers—from urban dwellers relying on rideshares to adventurous weekend travelers seeking peace of mind during their excursions.

Embracing these changes ensures that both insurers and insured can navigate this new era together—making roads safer one flexible policy at a time.

Other Links:

Gig Workers’ Guide to Insurance: How Freelancers Can Protect Their Health and Income

Is Pet Insurance Worth It in 2024? A Comprehensive Guide for Pet Owners

Securing Your Digital Wealth: The Rise of NFT and Cryptocurrency Insurance

Drone Insurance: How to Safeguard Your Investment and Stay Legal