Private Mortgage Insurance, or PMI, is a topic many homebuyers encounter when securing a mortgage. PMI protects the lender in case the borrower defaults on the loan, making it an important consideration for those with lower down payments. Understanding how PMI works can help buyers make informed decisions about their home financing.

The cost of PMI can add a significant amount to monthly mortgage payments. Buyers need to weigh the benefits of purchasing a home sooner against the extra cost PMI brings. Knowing how to avoid or remove PMI can also lead to financial savings over time.

Key Takeaways

- PMI is required for low down payment loans to protect lenders.

- The cost of PMI can increase monthly payments.

- It is possible to avoid or remove PMI with certain strategies.

What Is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is a type of insurance that lenders require if a borrower has a down payment of less than 20% on a home. It protects the lender in case the borrower defaults on the loan.

PMI typically costs between 0.3% to 1.5% of the original loan amount per year. The exact cost varies based on several factors, including the amount of the down payment and the loan type.

PMI can be paid in different ways:

- Monthly premiums: Added to the monthly mortgage payment.

- Upfront premium: Paid at the closing of the loan.

- Combination: A mixture of both upfront and monthly premiums.

Borrowers can cancel PMI when they reach about 20% equity in their home. They should contact their lender to request cancellation.

Some borrowers choose to avoid PMI by making a larger down payment. Others may look for lenders that offer alternatives to PMI, such as different types of insurance.

Knowing about PMI helps borrowers make informed decisions when purchasing a home. It can affect both monthly budgets and the total cost of the loan.

The Cost of PMI

Private Mortgage Insurance (PMI) can add extra costs to a home buyer’s monthly payment. Understanding what affects these costs is important for potential homeowners.

Factors Influencing PMI Rates

Several factors determine PMI rates. One important factor is the loan-to-value (LTV) ratio. A higher LTV ratio usually means higher PMI costs. For instance, if a buyer puts down less money, they might pay more for PMI.

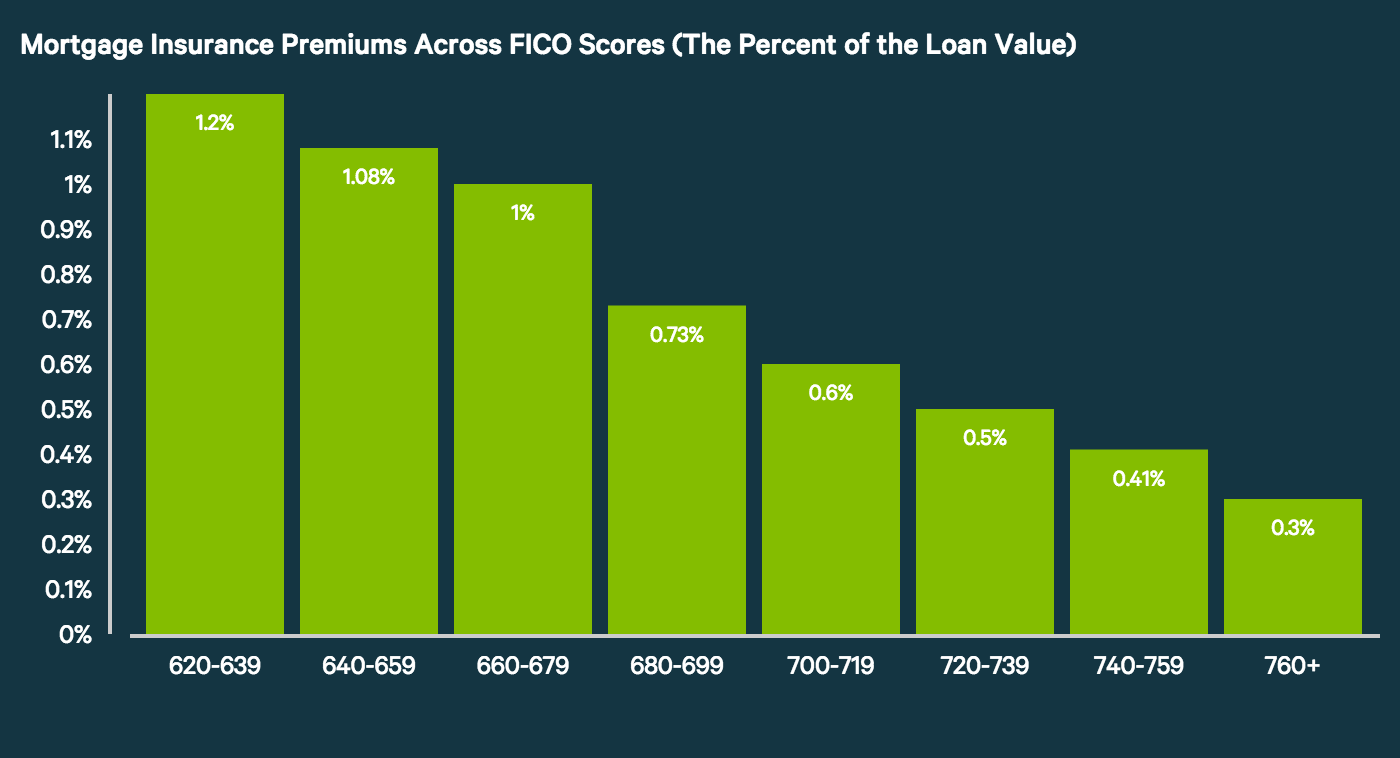

Another factor is the borrower’s credit score. A higher credit score often results in lower PMI rates. Insurers view borrowers with good credit as less risky.

The type of loan also plays a role. Conventional loans typically have different PMI costs compared to FHA or VA loans. Also, the coverage amount affects the cost. More coverage often leads to higher PMI premiums.

Average Costs

PMI costs vary. On average, PMI can range from 0.3% to 1.5% of the original loan amount each year. For a $200,000 mortgage, this could mean annual costs of $600 to $3,000.

Monthly premiums can be added to the mortgage payment. This might add $50 to $250 a month. Buyers must consider these numbers when budgeting.

Some lenders offer a one-time upfront PMI payment. This can reduce monthly payments. Annual renewal fees are also common, which are paid as part of escrow. Knowing these costs helps buyers make informed decisions about home financing.

Mow Read:

Mortgage Insurance Explained: What It Is and Why You Might Need It

Types of Coverage for NFTs Insurance

The Risks of Not Insuring Your NFTs and Crypto Investments

How to Protect Your Cryptocurrency: A Deep Dive into Digital Asset Insurance