In today’s digital landscape, small businesses are more vulnerable than ever to cyber threats. As technology advances, so do the tactics of cybercriminals. For many entrepreneurs, the thought of a data breach or ransomware attack can be overwhelming. Enter cyber insurance—a safety net designed specifically for these modern challenges.

Cyber insurance is becoming essential for small businesses in 2024. It provides not only financial protection but also peace of mind as you navigate an increasingly complex online world. But what exactly does it cover? How much should you expect to pay? And how can you choose the right policy for your specific needs?

This guide will walk you through everything you need to know about cyber insurance—from understanding its importance and types of coverage available to real-life examples of how it has helped other small businesses like yours thrive despite adversity. Whether you’re already considering a policy or just starting to think about protecting your business from digital threats, this essential guide will equip you with valuable insights and tips on keeping your company safe and secure in 2024 and beyond.

What is Cyber Insurance and Why is it Important for Small Businesses?

Cyber insurance is a specialized type of coverage designed to protect businesses from the financial repercussions of cyber incidents. This can include data breaches, hacking, and even system failures caused by malicious attacks.

For small businesses, the stakes are high. A single cyber incident could lead to significant losses—not just in money but also in customer trust and reputation. Many small companies lack the resources to recover quickly after an attack, making proactive measures essential.

Having cyber insurance provides a safety net that helps cover costs associated with these events. This includes legal fees, notification expenses for affected customers, and restoration of compromised systems.

As technology continues to evolve rapidly, so do the threats facing small businesses online. Investing in cyber insurance isn’t just smart; it’s becoming necessary for survival in today’s digital economy.

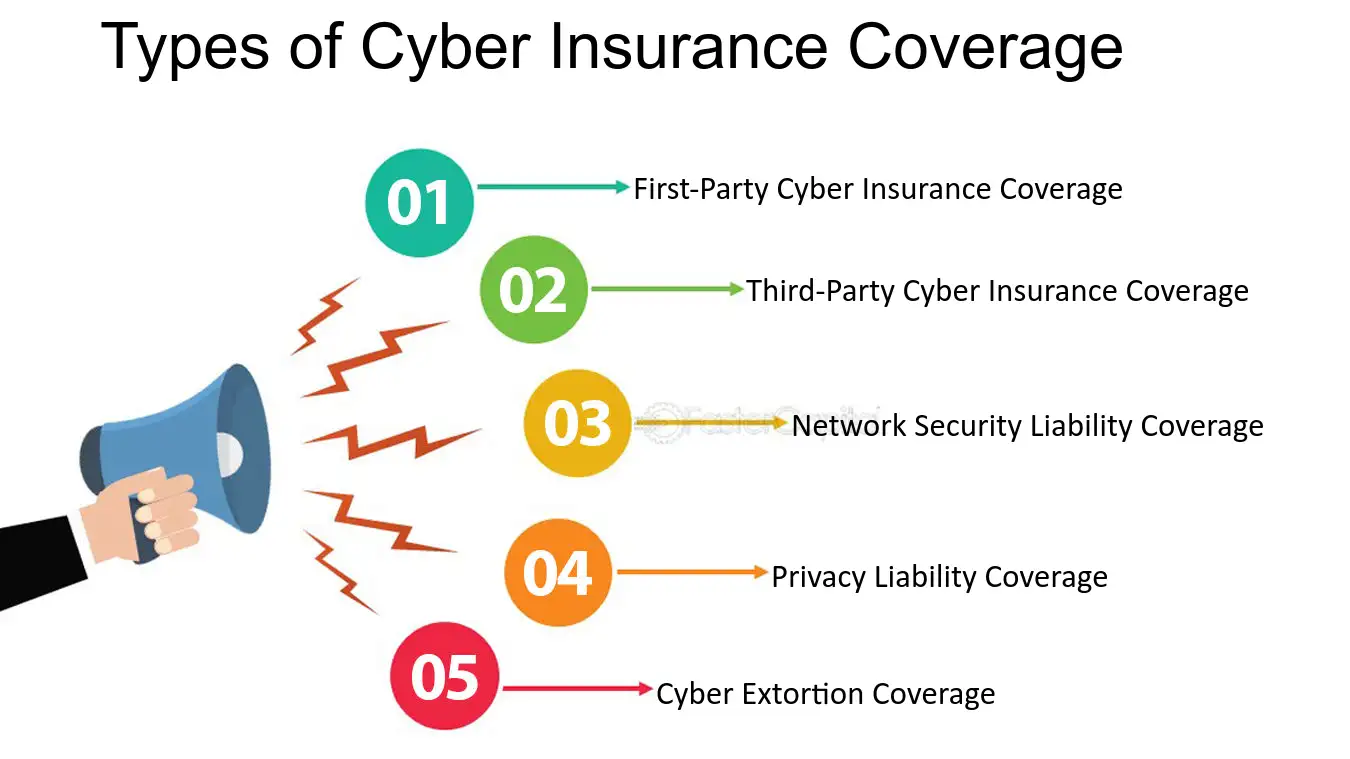

Types of Coverage Offered by Cyber Insurance

Cyber insurance offers a variety of coverage options tailored to the unique needs of small businesses. One key type is data breach coverage, which helps manage the costs associated with notifying affected customers and providing them with credit monitoring services.

Another important category includes network security liability. This protects against lawsuits stemming from unauthorized access or data breaches that compromise sensitive information.

Business interruption coverage can also be invaluable. If a cyber incident disrupts operations, this policy compensates for lost income during downtime.

Additionally, some policies offer crisis management support. This aids in handling public relations and restoring customer trust after an incident occurs.

Ransomware protection has gained prominence as threats evolve. It covers ransom payouts and expenses related to recovering encrypted data while navigating negotiations with hackers effectively.

The Cost of Cyber Insurance for Small Businesses

The cost of cyber insurance varies widely for small businesses. Factors like industry, size, and the type of coverage selected play a significant role in determining premiums.

On average, small business owners can expect to pay anywhere from $500 to $3,000 annually. However, this range fluctuates based on specific risks associated with their operations.

High-risk sectors often face higher costs due to increased likelihoods of attacks or breaches. Additionally, companies that have implemented robust cybersecurity measures may find lower premiums.

It’s essential for business owners to assess their unique needs before choosing a policy. Shopping around and comparing quotes will lead to better understanding and potentially more favorable rates.

Investing time in understanding these costs can save money while ensuring adequate protection against potential threats lurking online.

Steps to Choosing the Right Cyber Insurance Policy

Choosing the right cyber insurance policy involves several key steps. Start by assessing your specific needs. Understand the type of data you handle and your industry’s risk exposure.

Next, research different providers. Look for insurers with experience in your sector. Their expertise can make a significant difference during claims.

Evaluate coverage options carefully. Policies vary widely, so ensure they cover potential threats like data breaches or ransomware attacks.

Don’t forget to check the claims process. A straightforward and responsive process is essential when you need support most.

Consult with an expert if necessary. An insurance broker specializing in cyber policies can offer valuable insights tailored to your business’s unique risks and requirements.

Common Misconceptions about Cyber Insurance

Many small business owners assume that cyber insurance covers every type of cyber incident. This isn’t true. Policies vary widely, and some may exclude specific threats like social engineering attacks or insider breaches.

Another common misconception is that only tech companies need this coverage. In reality, any business with an online presence faces risks, from retail stores to healthcare providers.

Some believe purchasing a policy guarantees complete security against cyber risks. However, while it provides financial protection after an incident, it doesn’t prevent breaches from occurring in the first place.

Many entrepreneurs think that once they buy a policy, they can forget about cybersecurity measures altogether. Regular updates and proactive strategies are essential components in safeguarding their digital assets even after securing insurance.

Real Life Examples of Small Businesses Benefiting from Cyber Insurance

A small marketing agency in Texas faced a ransomware attack that locked all its client data. With cyber insurance, they quickly recovered the costs associated with the breach. This allowed them to restore their systems and retain valuable clients.

Another example is an online retailer in California. After a data leak exposed customer information, their policy covered legal fees and notification expenses. The business was able to focus on improving security measures rather than stressing about finances.

In New York, a local law firm experienced a phishing scam that drained funds from their accounts. Their cyber insurance helped cover losses and aided in investigations to enhance future protections.

These stories showcase how crucial cyber insurance can be for small businesses dealing with unexpected digital threats. Having this safety net allows companies to bounce back faster while maintaining trust with customers.

Tips for Mitigating Cyber Risks in Addition to Purchasing Insurance

Investing in cyber insurance is vital, but it shouldn’t be your only line of defense. Creating a solid cybersecurity culture within your business can make a significant difference.

Start by training employees on safe online practices. Encourage them to recognize phishing scams and suspicious links. Regular workshops can foster awareness and vigilance.

Next, implement strong password policies. Use multi-factor authentication wherever possible to add an extra layer of security.

Regularly updating software is crucial too. Many breaches occur due to outdated systems that are easy targets for hackers.

Consider conducting regular security assessments or hiring outside experts to identify vulnerabilities in your network. An objective perspective often uncovers blind spots you might miss internally.

Back up data consistently and store it securely offsite or in the cloud. This way, even if a breach occurs, you have robust recovery options available without losing valuable information.

The Importance of Protecting Your Business with Cyber

Protecting your business in today’s digital landscape is non-negotiable. Cyber threats are increasing, and small businesses often find themselves on the frontline of these attacks. Investing in cyber insurance can provide a vital safety net, safeguarding your finances and reputation against potential breaches.

Having the right policy means you’re not just reacting to incidents but proactively managing risks. It offers peace of mind that helps you focus on what truly matters: running your business. Coupled with robust cybersecurity measures, cyber insurance creates a comprehensive defense strategy.

As technology evolves, so do the tactics used by cybercriminals. Small businesses need to stay informed and prepared. Embrace this crucial step towards securing your enterprise’s future. Every precaution counts in building resilience against unforeseen challenges.

Cyber insurance isn’t just about recovery; it’s also about growth and sustainability in an ever-changing environment where data protection has never been more critical for success.

Read More:

Drone Filming? Here’s Why You Need Specialized Insurance for Your Next Big Project

The Growing Need for eSports Insurance: Protecting Gamers and Events in 2024

How Parametric Insurance is Saving Businesses from Natural Disasters

Event Cancellation Insurance: Why Every Event Planner Needs It in Uncertain Times